Crypto Mining Insights: Strategies and Lessons Learned

Written on

Chapter 1: Reflections on a Year of Mining

After a full year of mining during this bullish market, I've gathered numerous insights from acting on my desire to engage in this activity. Mining has proven to be an enjoyable and potentially lucrative pursuit for those who have the financial resources and the patience to invest in and set up a mining rig. However, I urge those contemplating entry into the mining space to assess the current landscape and anticipate changes in the coming months. Notably, Ethereum, the largest and most lucrative proof-of-work (PoW) blockchain, is transitioning to a proof-of-stake (PoS) consensus model, eliminating the need for mining. This shift will create a significant gap for miners and GPUs, likely resulting in decreased profitability for other cryptocurrencies as many miners migrate from Ethereum.

Mining Themes for 2022

In reflecting on my mining journey, I can break it down into several key stages:

- Learning How to Start Mining

- Optimizing Equipment

- Focusing on Efficiency and Costs

- Understanding Stability

- Formulating a Strategy

Chapter 2: Getting Started with Mining

The initial phase of my mining experience involved understanding what computer components and accessories were necessary for my setup. It was crucial to grasp the basics, including power supplies, motherboards, CPUs, and GPUs, ensuring compatibility among these parts. Fortunately, there are plenty of excellent online resources, such as forums and YouTube channels, that make the onboarding process quite straightforward. Some of my go-to resources include r/Ethmining, Mining Chamber, Seb Hzelo, Voskcoin, Red Panda Mining, and Red Fox Crypto. These platforms provide detailed guides on components, installations, and optimizations.

Optimizing Equipment

One of the early challenges I faced was scaling my mining operation. I made the mistake of purchasing a case that could only accommodate 2-3 GPUs. After installing my first card, I realized that expanding my setup would require additional investments in a larger case and other necessary components. It’s essential to choose an open-air mining rig frame that offers ample space for wiring and troubleshooting, as a cramped environment can complicate repairs.

When it comes to acquiring GPUs to enhance mining efficiency, there are two primary strategies, largely determined by your available capital. The first approach involves actively monitoring Discord channels and Twitter accounts for GPU restocks, allowing you to buy at retail prices. The second, more capital-intensive strategy entails paying a premium for a complete setup upfront. While the first method is more cost-effective, it may lead to a piecemeal rig assembly over time, potentially missing out on mining opportunities.

Focusing on Efficiency and Costs

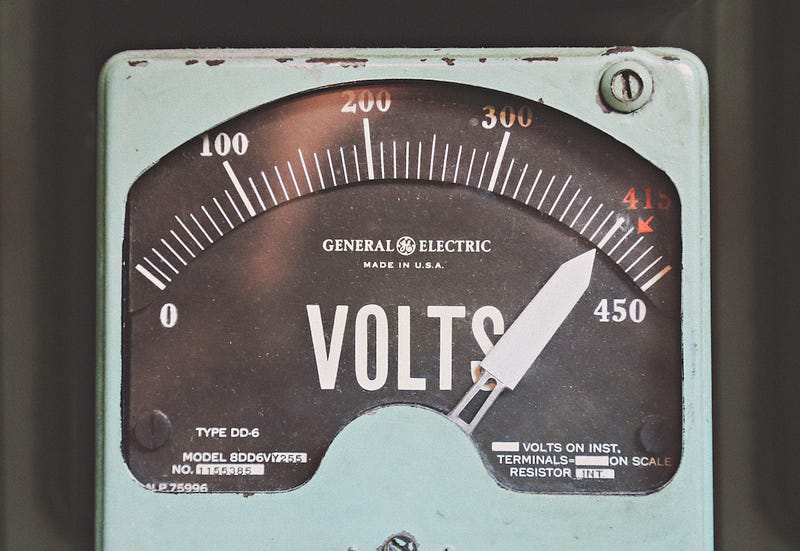

Once my mining rig was operational, I was eager to maximize its performance. However, I soon realized that pushing the hash rate too hard could lead to increased energy costs. Balancing power consumption with hash rate was vital, as running the rig at maximum capacity often resulted in higher temperatures and potential issues. As I grew more comfortable with my setup, I began tweaking my overclock settings to reduce energy use without sacrificing performance. For instance, I managed to decrease the power consumption of my RTX 2060 from 100W to 79W while maintaining the same hash rate, achieving a nearly 20% reduction in energy costs.

Understanding Stability

Stability is another critical aspect related to efficiency and overclocking. Pushing GPU limits can lead to system instability and crashes. It’s essential to configure your mining motherboard for reliable booting and to establish a method for remote monitoring and adjustments. I am still refining this process to ensure maximum uptime. Achieving a robust setup that minimizes downtime is crucial, as even minor crashes can negate the benefits of slight hash rate increases.

Formulating a Strategy

Your mining strategy should align with your personal objectives, whether you're seeking active income, acquiring coins at a lower cost, or speculating on future values. Personally, I mine primarily for investment purposes, focusing on maximizing coin yield. I concentrate on mining Ethereum while remaining alert to other promising cryptocurrencies that may offer better returns during periods of lower network hash rates. While I primarily mine Ethereum, I’m open to switching to other coins if conditions are favorable.

Be cautious about investing time in very small projects, as most may not yield significant returns, and the mining time spent could be better allocated elsewhere.