Exploring Opportunities in the UK Electric Vehicle Charging Market

Written on

Chapter 1: Introduction to the Market

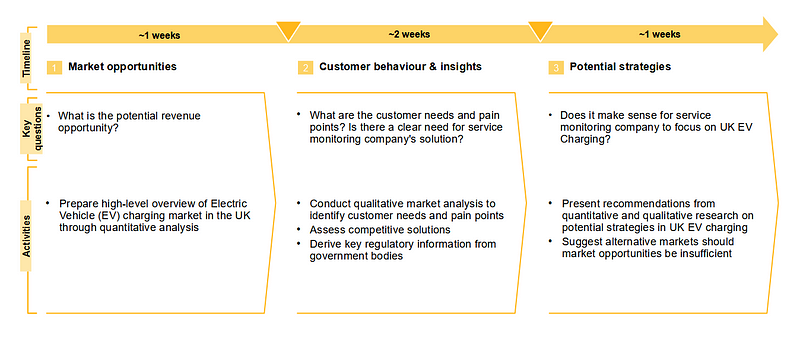

In this consulting engagement, I evaluated the growth potential within the UK Electric Vehicle (EV) charging sector for the CEO of a prominent service monitoring firm specializing in connected devices across Europe. My analysis encompassed market opportunities in the UK EV charging landscape, customer requirements, and challenges, as well as possible strategic approaches in IoT analytics and smart energy.

The service monitoring company in question operates as a B2B SaaS provider, delivering tools that help businesses manage IoT devices. Their offerings include service monitoring, management, and automation solutions, all aimed at enhancing service quality through no-code incident management, performance metrics, and automation of business processes.

Project Overview

The CEO tasked me with assessing the feasibility of entering the Electric Vehicle charging market in the UK, especially in light of a potential capital raise planned for the upcoming year.

Research Methodologies

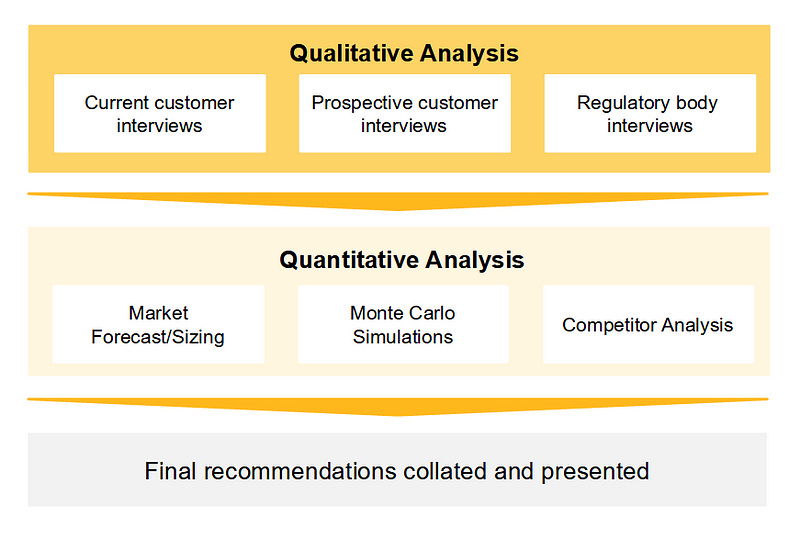

Qualitative Analysis

Goals: Identify the needs, pain points, and interest in the service monitoring company's solutions.

Quantitative Analysis

Goals: Estimate potential revenue opportunities in the UK EV charging market.

Qualitative Insights from Interviews

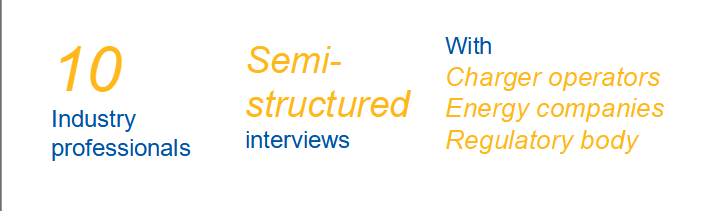

Ten semi-structured interviews were conducted, yielding valuable insights into customer pain points and expectations.

Interview Findings

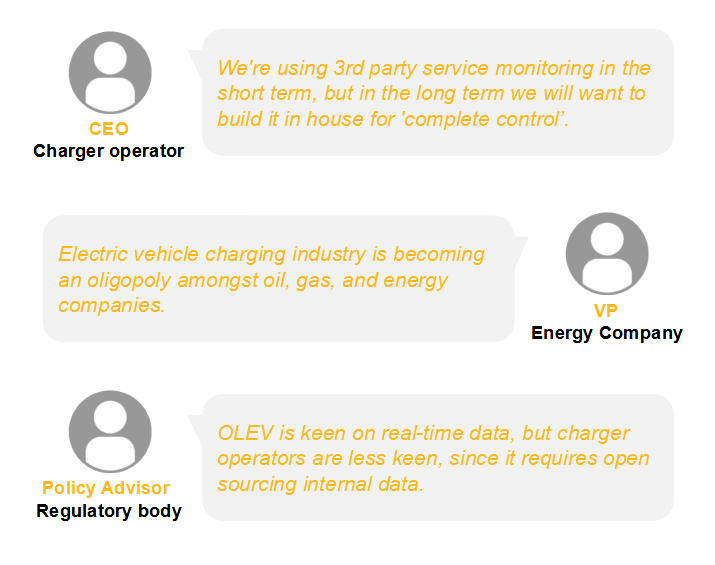

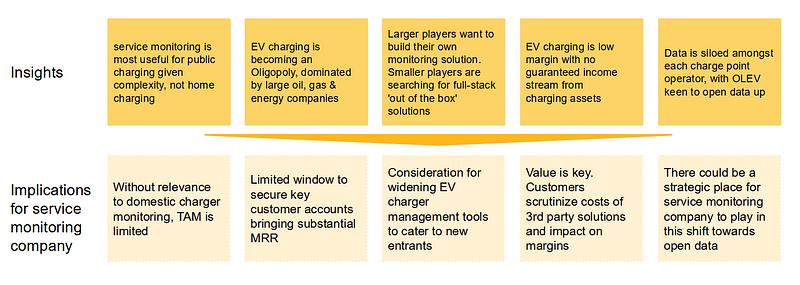

The semi-structured interviews unveiled several critical insights regarding customer needs and the competitive landscape.

Competitor Landscape

The service monitoring company's competitors can be categorized into three main groups, each providing diverse services throughout the EV software ecosystem.

Quantitative Analysis

Market Size and Forecasts

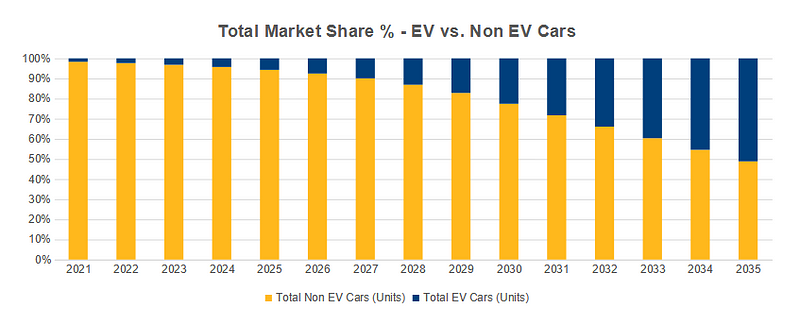

While traditional car sales are declining at a rate of approximately 1.7% annually, the EV sector is expected to expand at a staggering 30% each year. The UK government mandates that by 2035, all new cars sold must be EVs, aiming for a 50% market share by that time. My model predicts that by 2030, EVs will account for around 93% of new car sales, with a market share of 51-52% by 2035.

Revenue Potential Estimation

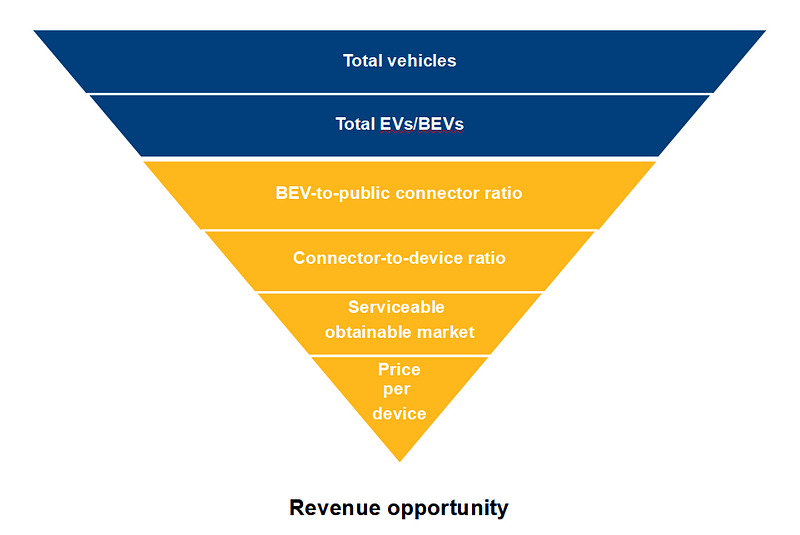

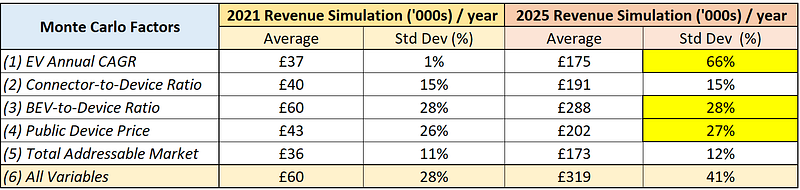

The EV smart-charging industry is characterized by several unpredictable elements. To estimate various revenue scenarios, I employed a Monte Carlo simulation focusing on public chargers, as engaging with private chargers poses challenges for the service monitoring company in the short to medium term.

Video Description: This video explores innovative methods to enhance power grid reliability using IoT analytics.

Test Variables:

- New EV CAGR

- Connector-to-device ratio

- New passenger car CAGR

- BEV-to-connector ratio

- Service monitoring company’s serviceable obtainable market

- Price per device

Short-Term Revenue Forecast

Projected annual revenues range from £36,000 to £92,000, with an average estimate of £60,000.

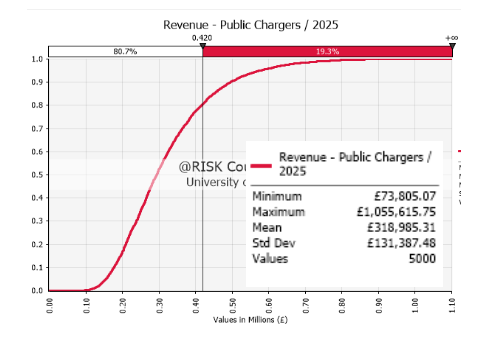

Mid-Term Revenue Outlook

There is a 20% probability of achieving £35,000 MRR by 2025, with most likely revenues at around £320,000 per year or £27,000 monthly. The analysis shows a high standard deviation, indicating significant market uncertainties.

Sensitivity Analysis

By evaluating variables with the highest standard deviations, the following key factors were identified:

- EV annual growth rate, influenced by government policies and incentives

- BEV-to-device ratio, affected by regulations mandating public charger installations

- Price per public EV charger, shaped by both the service monitoring company’s strategies and customer willingness to pay

Key Takeaway

The primary factors that will impact the service monitoring company's revenues are largely beyond its influence.

Recommendations

Synthesis of Findings

- Qualitative Analysis: A growing oligopoly in EV charging is emerging, with major oil, gas, and energy firms planning to deploy their own monitoring solutions. Smaller competitors are worried about low margins and are interested in maximizing the utility of third-party tools.

- Quantitative Analysis: Given the complexities involved, there is a 20% chance of reaching the £35,000 MRR target by 2025. Influential factors affecting revenue are primarily outside the company’s control.

Market Conclusion

The UK EV charging sector does not offer a substantial revenue opportunity that justifies sole focus from the service monitoring company.

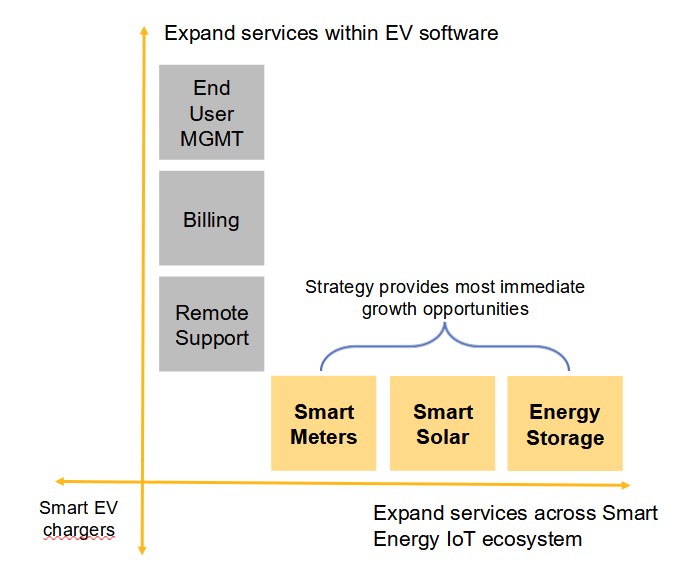

Strategic Considerations

In light of the limited market size and the high level of competition among software providers for EV charge point operators, it would be prudent to consider horizontal or vertical service expansions. A logical path for growth involves connecting additional IoT devices within the smart energy sector, leveraging the service monitoring company’s current capabilities.

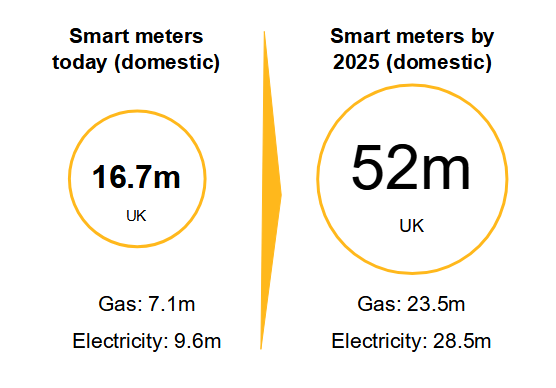

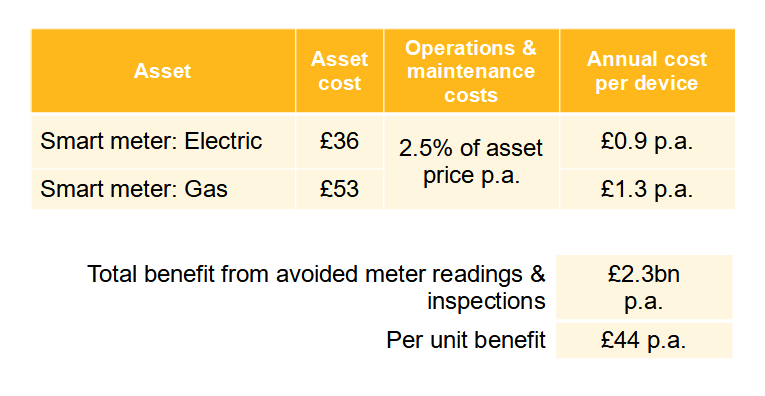

Exploring New Assets: Smart Meters

Venturing into IoT devices in other smart energy domains could significantly enhance the Total Addressable Market (TAM) for the service monitoring company, with smart meters representing a promising business opportunity.

Regulatory Context: "From July 2021, suppliers must adhere to a new regulatory framework for smart meter deployment, with binding annual installation targets extending until mid-2025." — Office for Gas and Electricity Markets (2020)

Conclusion

The UK EV charging market does not provide a compelling revenue opportunity for the service monitoring company to prioritize. The majority of potential revenue streams are transitioning towards an oligopoly, where many players are inclined to develop their own in-house solutions. As the company prepares for a capital raise next year, exploring other smart energy assets, such as smart meters, may yield more significant revenue prospects.

References

- Hirst, D., 2020. Electric vehicles and Infrastructure, London: House of Commons Library.

- Statista, 2020. Number of licensed cars in the United Kingdom (UK) from 2000 and 2019. [Online]

Video Description: This video discusses how to enhance IoT analytics using the Data to Insights Accelerator on AWS for renewable energy sources.