# Understanding STEPN: The Impact of ETH Gas Fees on Your Rewards

Written on

Chapter 1: Introduction to STEPN and Its Evolution

STEPN has emerged as a groundbreaking application in the crypto and web3 lifestyle space, captivating users since its inception in early 2022. It ignited a wave of move-to-earn applications, positioning itself as a leader in this new sector. After triumphing over 500 competitors at Solana's hackathon in 2021, this Solana-native project, supported by prominent investors like Alameda, Binance, and Sequora, rapidly expanded to include the BNB Chain and Ethereum ecosystems.

This app has positively impacted countless lives, encouraging users to adopt healthier lifestyles by rewarding them for physical activity. As a dedicated user since May 2022, I can attest to its effectiveness.

To participate, users simply purchase a pair of NFT sneakers and earn cryptocurrency for their daily walks, jogs, or runs. The GST tokens accumulated can be utilized to enhance the sneakers or exchanged for fiat currency.

The development team has introduced various engaging mechanics, including shoe minting and the chance to earn mystery boxes for extended workouts. Upcoming features promise even more excitement, such as earning STEPN's deflationary governance token (GMT), the introduction of a Marathon mode, and the ability to rent sneakers. It's important to note that STEPN is still in beta.

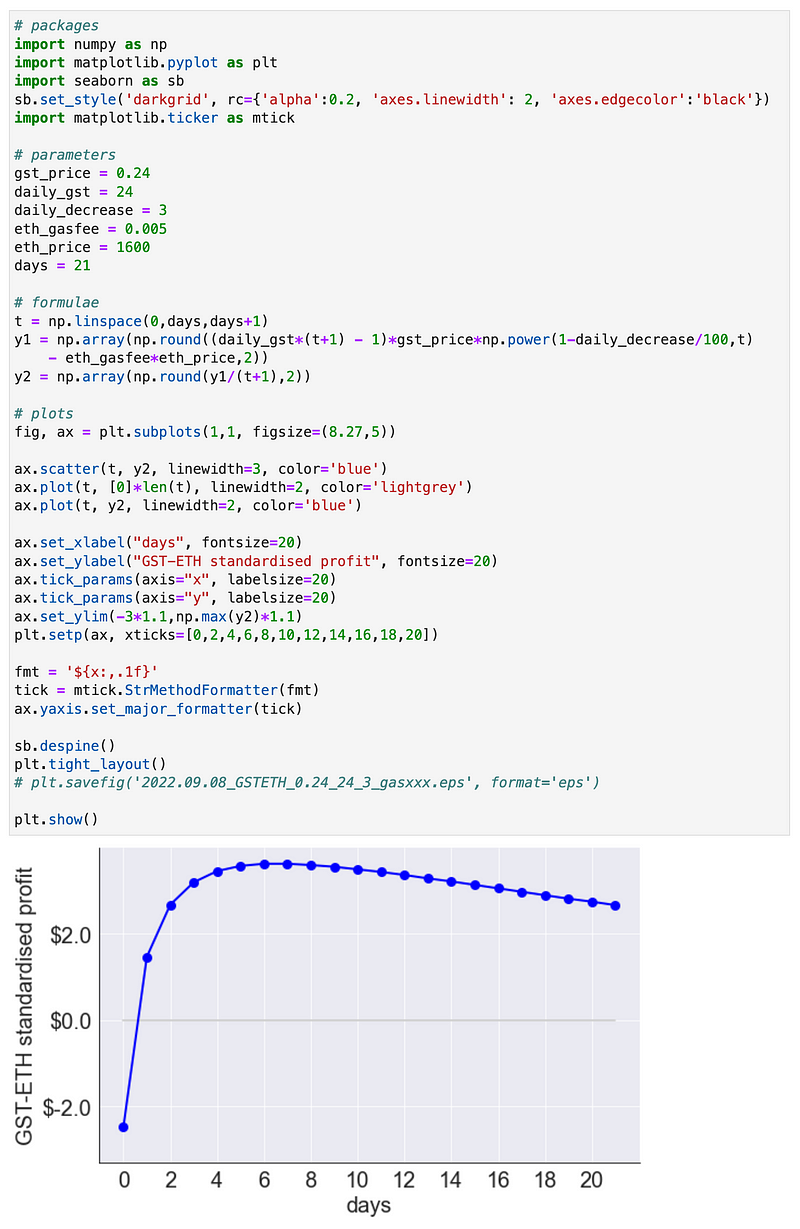

In this article, I will analyze the factors influencing how frequently you should cash out your rewards in STEPN's APE Realm. With the GST price declining, players must weigh their profits against Ethereum's sometimes steep gas fees.

Does it make sense to cash out daily in the APE Realm? Or perhaps every other day or third day?

The key variables to consider are:

- Current GST price

- Daily GST earnings

- Rate of GST decline

- Ethereum gas fees

Let's delve into the results and explore the calculations.

Chapter 2: Calculating Optimal Cash-Out Strategies

For the following simulations, I will assume you possess a Level 9 Common sneaker (4 energy) that generates approximately 24 GST per day, with GST priced at 24 cents and declining at a rate of 3% daily, based on a rolling seven-day average. The Ethereum price is set at $1,600 for these calculations.

We will examine ETH gas fees across low, average, and high scenarios.

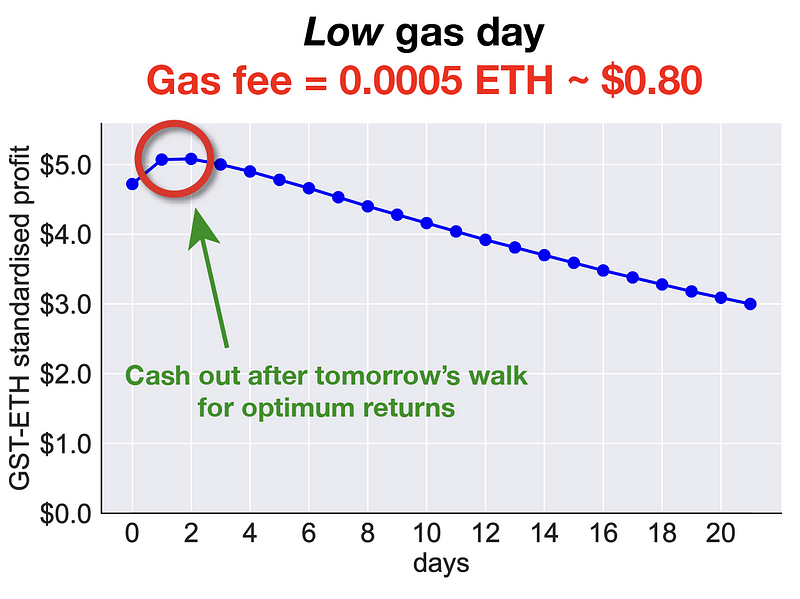

Swapping on a Low Gas Day

On a day with low gas fees, the cost of converting $eGST to $USDC will be about 0.0005 ETH, translating to roughly 80 cents. Your walking rewards of 24 GST would equate to around $5.70, demonstrating that ETH gas fees can significantly impact your overall profit. So when is the optimal time to cash out?

The graph indicates that the best strategy is to wait until after your next walk to maximize returns. By doing so, you can combine two days' worth of eGST, thereby distributing the 1 GST + 0.0005 ETH gas fee across both days.

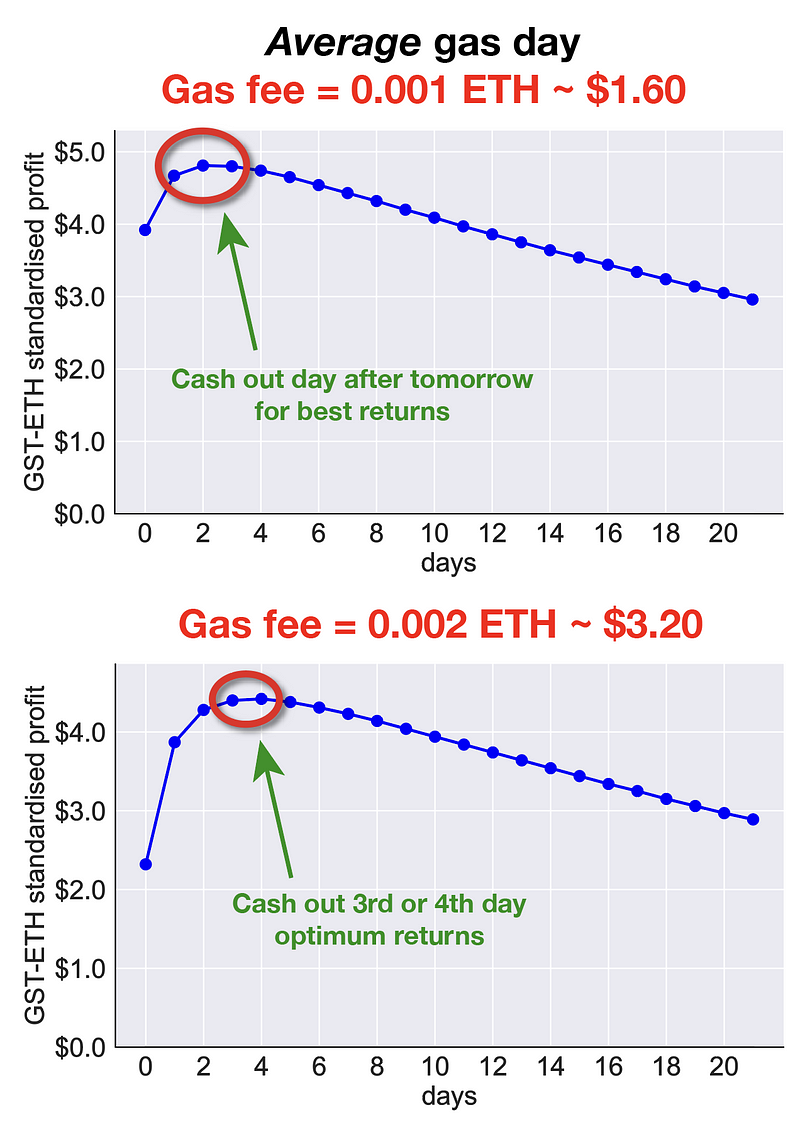

Swapping on an Average Gas Day

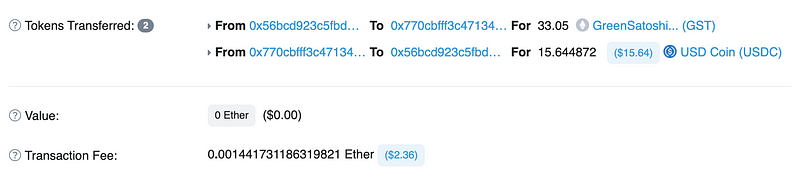

Typically, my gas fees range from 0.001 to 0.002 ETH.

This results in fees around $2 to $3.

Under these conditions, the ideal cash-out window extends from the day after your walk to as late as day four. The higher the gas fee, the longer you should wait to accumulate GST.

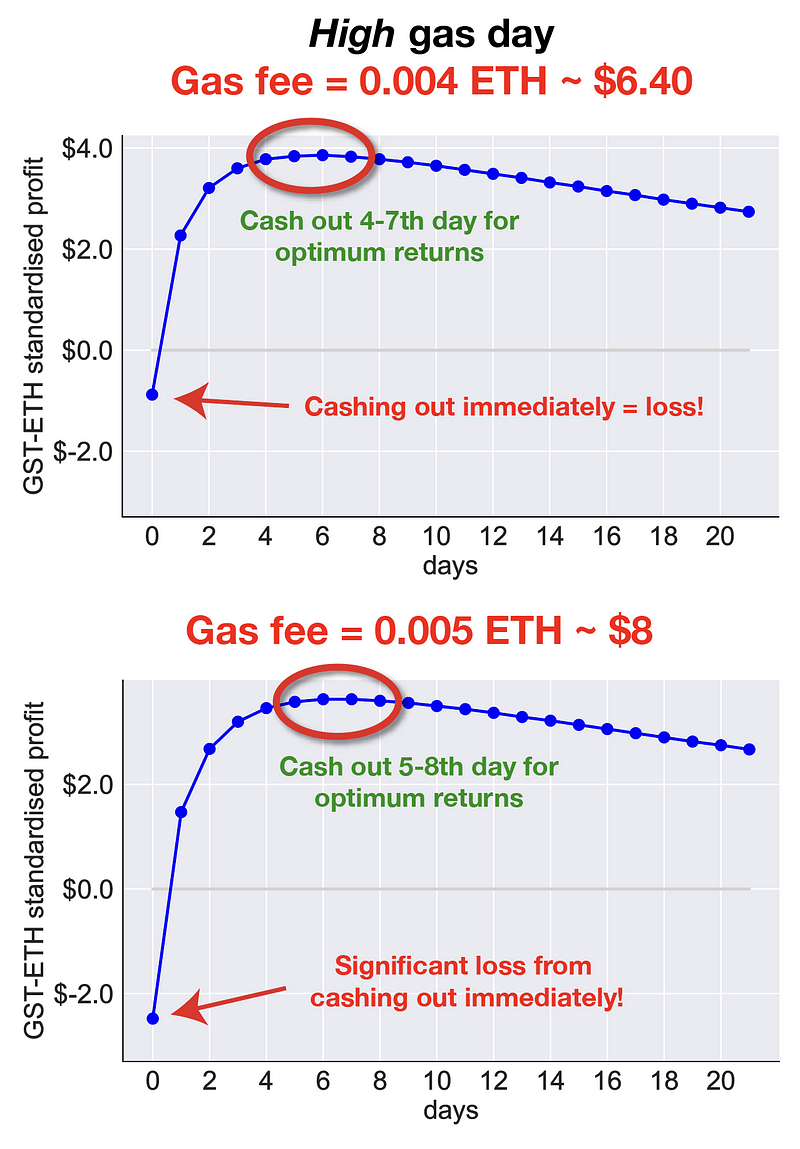

Swapping on a High Gas Day

On less favorable days, gas fees can reach up to 0.005 ETH, which amounts to $8!

The data suggests that you should consider cashing out after waiting four to five days or longer. Cashing out sooner could result in significant losses due to high ETH gas fees.

Chapter 3: Understanding the Financial Implications

What do the vertical axes represent in these graphs? Simply put, they indicate the 'standardized' GST profit from today's activity as you delay cashing out.

For instance, in the high gas fee example, your 24 GST (valued at $5.70) could lead to a loss of approximately $2.50 after factoring in the 1 GST plus roughly 0.001 ETH gas fee. However, if you wait until Day 5 to cash out, the total accumulation of 144 GST can yield an approximate profit of $21 after fees, resulting in a standardized value of $3.50 for each batch of 24 GST.

Essentially, distributing a high gas fee of $8 across six days’ worth of GST earnings (totaling 144 GST) becomes manageable compared to incurring it for just 24 GST immediately.

If the math seems overwhelming, don’t fret! The essential takeaway is that by observing the graphs, you can easily identify the optimal cash-out point at the peak of the curve.

I also want to mention some assumptions made for these simulations:

- ETH Pricing: I've used $1,600 for these examples. If ETH decreases, it could become more advantageous to cash out more frequently.

- Daily GST Decline Rate: The rolling seven-day average is around 3%, but this may decelerate as GST nears a floor price of approximately 4-5 cents, which is currently being defended on Solana and BNB. This price point could act as a rough baseline for ETH as well.

Chapter 4: Conclusion and Recommendations

Many players on Ethereum operate with a single Common shoe setup that has 4 energy (thanks to the Solana-BNB energy bridge). Given the current GST price of 24 cents, cashing out on the same day is not advisable.

Consider this: an 80-cent ETH gas fee versus rewards of $5–6 is a steep cost! Ideally, you should cash out after your walk the following day, especially on low gas fee days.

On high gas days, where fees can soar to 0.005 ETH (~$6–8), delaying cashing out for 5–8 days will prove beneficial. Generally, expect to pay between 0.001 and 0.002 ETH for a GST-USDC swap on STEPN’s DOOAR DEX, resulting in fees of about $2–3. In this case, waiting one or two days post-walk often yields the best results.

Keep in mind that these simulations are based on a single Common shoe earning 24 GST daily, which is typical for many STEPN APE users.

Are you using a different setup in STEPN, such as multiple shoes or an Uncommon? Be sure to check out my previous article where I analyzed optimal returns across various shoe portfolios and GST prices.

Thank you for reading!

Follow me on Twitter and YouTube for more insights and guidance.